The Ultimate Course for Payroll Management Mastery

Elevate your skills and become a certified payroll expert with our comprehensive program, designed by Human Resource and Tax professionals to simplify complex concepts and ensure your success

Program Details

Course Information at a Glance

- Program Category: Certificate in Skills Upgrading

- Evaluation Method: Continuous assessments & online exam

- Resource Persons: Human Resource & Tax Consultants

- Program Fee: Standard Program Fee - Rs 18,000 (all inclusive)

- (Registration fee: Rs 2,000.00 + Program fee: Rs 16,000.00)

- Installment payments: Rs 9,000.00 X 2 installments

Program Overview

What to Expect from Our Program

Gain complete knowledge about payroll management, updated labor laws, and taxation, all presented in an easily understandable format.

- Specially designed by Human Resource and Tax professionals

- In-depth coverage of all aspects of payroll management

- Practical approach for real-world application

- Continuous assessments and online exams for thorough evaluation

Why Choose This Program

Invest in Your Career with Our Job-Oriented Course

Our program offers numerous benefits that make it the ideal choice for professionals looking to excel in payroll management.

- 100% job-oriented curriculum

- Affordable fee structure

- Gain the ability to handle payroll independently

- Acquire practical knowledge for real-world application

- A valuable investment for your career

Course Modules

Comprehensive Modules for a Holistic Learning Experience

Our course covers all essential aspects of payroll management to provide you with the skills and knowledge required for success in the field.

Component of Payroll: Dive into the fundamentals of payroll management, learning about the various elements that make up an employee’s salary, such as basic pay, allowances, deductions, and reimbursements.

Minimum Wage & Computation of BR Allowances: Understand the importance of minimum wage requirements and how to accurately calculate the Basic Rate (BR) allowances, ensuring compliance with labor laws and fair compensation for employees.

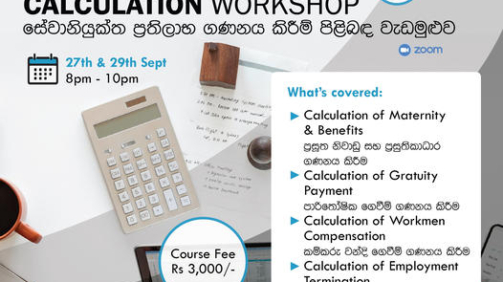

Computation of Overtime Payments: Master the process of calculating overtime payments for employees, taking into account factors such as working hours, hourly rates, and applicable regulations.

Computation of Staff Leaves: Gain expertise in managing and computing staff leaves, including annual, sick, and maternity leaves, to maintain a balanced and productive work environment.

Computation of Holiday Payments: Learn how to accurately compute holiday payments for employees, considering factors like holiday entitlements, working patterns, and relevant labor laws.

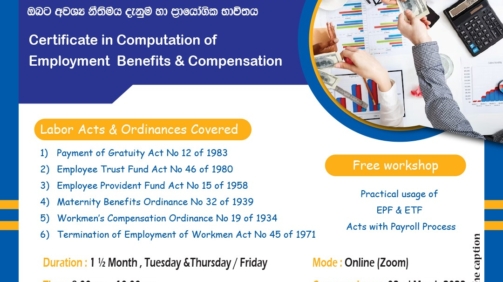

Computation of EPF & ETF Contributions: Acquire in-depth knowledge of the Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF) contributions, understanding how to compute and remit these mandatory deductions accurately.

Employment Tax: Explore the intricacies of employment tax, including its impact on payroll, the different tax brackets, and relevant regulations, ensuring full compliance with tax laws.

Authorized Deductions of Salary/Wage: Understand the various authorized deductions from an employee’s salary or wage, such as loan repayments, insurance premiums, and union fees, ensuring that all deductions are lawful and transparent.

Manual Payroll Process: Learn the steps involved in manually processing payroll, from collecting employee data to calculating pay and issuing payslips, providing you with a strong foundation in payroll management.

Offenses & Penalties: Familiarize yourself with the legal consequences of non-compliance in payroll management, including offences, penalties, and other repercussions, ensuring that you stay well-informed and fully compliant with all regulations.

Register Now

Next Certificate Batch

Rs. 18,000

Register Now

Our Next Free Workshop

Participate in our 4-hour practical workshop on the practical usage of EPF and ETF Acts in payroll management, available to all program participants.